4 major trends caused by covid-19 and how to respond [data]

Содержание:

- Fast-forward trend 5: Private and social sectors step up

- Homeschooling

- Generational Purchasing Responses to COVID-19

- Home fitness

- Shipping and Fulfillment Providers

- Fast-forward trend 3: Rising competitive intensity

- Working from home

- Fast-forward trend 1: Digitization

- Understanding Panic Buying and Coronavirus

- Fast-forward trend 4: Consumers come of age

- Next steps for retailers

- The trend: Cross-network opportunities grow as Google search traffic falls

- The trend: COVID-19 dominates new searches

- Is it Safe to Order Online During COVID-19?

During the 2003 SARS outbreak, the government and state-owned enterprises (SOEs) were the primary actors during the economic recovery. Now, the private sector and leading technology companies are playing a more significant role, making large socioeconomic contributions amid the emergence of powerful social institutions that have donated millions to recovery efforts. Policy debates also indicate COVID-19 might be accelerating long-awaited structural reforms to land, labor, and capital markets.

In the wake of the 2003 SARS outbreak, SOEs were the major driver of China’s economy, accounting for about 55 percent of China’s assets, and 45 percent of profits. Today, the private sector contributes close to two-thirds of China’s economic growth, and 90 percent of new jobs, illustrating a significant shift in the balance of economic power. In the wake of COVID-19, joint efforts between government and large private companies have played a leading role. For example, Alipay and WeChat supported the Shanghai government’s “Suishenma” health QR code launch to help contain the spread of the virus.

These actions illustrate the growth of the private sector, its ability to participate in activities of national importance, and the potential of public–private partnerships. Meanwhile, social institutions including the Bill & Melinda Gates Foundation and the Vanke Foundation have donated millions of dollars to aid recovery efforts. We expect social institutions like these to play a vital role in shaping Chinese society going forward.

In the rest of this report, we explore in more depth how five key trends that have been shaping the Chinese economy have been accelerated by the onset of the COVID-19 crisis.

Download Fast forward China: How COVID-19 is accelerating 5 key trends shaping the Chinese economy, the full report on which this article is based (PDF–844KB).

Interview

Homeschooling

Schools, colleges, and universities have had to follow in suit with workplaces. With a pattern in mentions very much like the above.

There was a brief peak in mentions of homeschooling before the prime school closure conversation on March 13. But the real realization of the task ahead didn’t hit until Tuesday March 17. Sample: 2%

The real story here though, is that while working from home peaked then stabilized within one week, homeschooling is driving peaks week after week. Totaling 4.49 million mentions throughout March.

People are struggling to adapt to teaching children at home, and creating more conversations each week seeking help and advice. Only the weekends bring some respite.

What conversations are driving the trend?

Unsurprisingly, public closures dominate the conversations related to homeschooling (21.8%). This wasn’t by choice, but the only option to take when faced with the ongoing situation.

Teaching resources (17.1%)

Again, the community was quick to respond to meet the new requirements of homeschooling. Whether teachers having to adapt to a remote teaching role, or parents learning to become home teachers (often while juggling working from home too), everyone is having to learn new skills.

With many businesses and professionals providing the resources and tools they need.

Helping provide relevant resources ensures your brand remains a vital part of your consumer mindset.

Parental viewpoint (14.5%)

As parents adapt to their new role, they’re sharing their stories online. Whether positive or negative, successful or otherwise, people are having to share their experiences as part of the coping mechanism. Finding social interactions, and community support, even when face-to-face isn’t possible.

These conversations are demonstrating the needs that consumers require the most, and would be valuable to interact with if possible.

Facing new challenges, users are turning more to social media to look for help and support. Brands should try to help in these conversations where possible.

Other major conversations

People disliking online classes (10.1%)

Some students are struggling to adapt to the changing environment, with many not liking the new online class structure. Expect this to drop as people get used to the change.

Some of the online class dislike is due to people missing the social interaction of school.

Paid student impersonation (4.9%)

There’s always someone that looks to profit from every situation. There’s been a rise of businesses offering to sit exams or classes, or write papers for students.

Educational facilities should be aware of the increased risk of this kind during this time.

Technical requirements (and lack of) (3.8%)

To make homeschooling work, students require more technical support, with items such as tablets, computers and internet. This change has highlighted a gap in technical support in some areas.

As a business, if you can help support this issue in any way, do.

Homeschooling — brands

The brands relating to homeschooling are similar to working from home, dominated by tech suppliers, offering the facilities classrooms need to keep in touch.

One brand that stands out from this, is Lego. That’s due to many turning to the construction toy as a form of educational play. With the company supporting through their own initiatives.

Encourage users to connect and engage, by promoting active play.

Mentions of Lego’s #LetsBuildTogether increased 1500% in the last week of March.

Generational Purchasing Responses to COVID-19

The response to COVID-19 hasn’t been universally felt across generations, with consumers of different age groups responding differently to the crisis.

It is important to caveat that this is a rapidly evolving situation so surveys are quickly outdated as behaviors change with the circumstances. This applies to data shared here and below.

1. Gen Z and Millenials.

While people in general are concerned about the growing pandemic, the youngest generations are particularly altering their purchasing behaviors.

One survey of U.S. and U.K. consumers found that 96% of Millenials and Gen Zs are concerned about the pandemic and its effects on the economy. This concern is leading them to change their behavior more dramatically than other generations, which includes cutting back on spending, stocking up on items, and spending less on experiences.

2. Gen X and Boomers.

Although still concerned about coronavirus and its effects on the economy, older generations are slightly less concerned than younger generations and letting it impact their shopping habits less. For example, 24% of Boomers and 34% of Gen X said they were letting current events impact what items they purchase, compared to nearly half of Millennials.

Home fitness

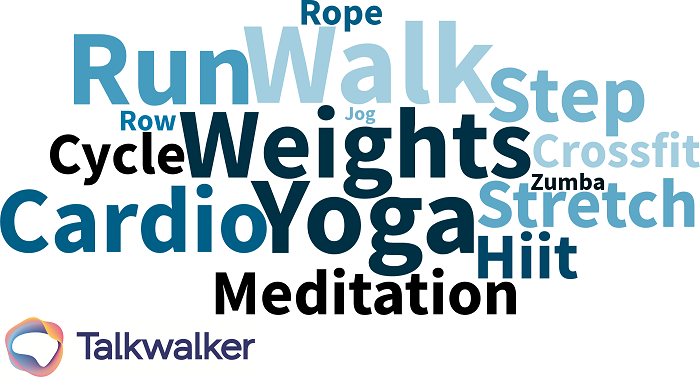

One consistent message globally, is that even during lockdown, people are still encouraged to take daily exercise. More so than they ever have been before. With 66K mentions in March, compared to the 97.6K mentions from the previous 12 months.

Daily exercise is a huge priority during the lockdown. Even though it didn’t matter much before.

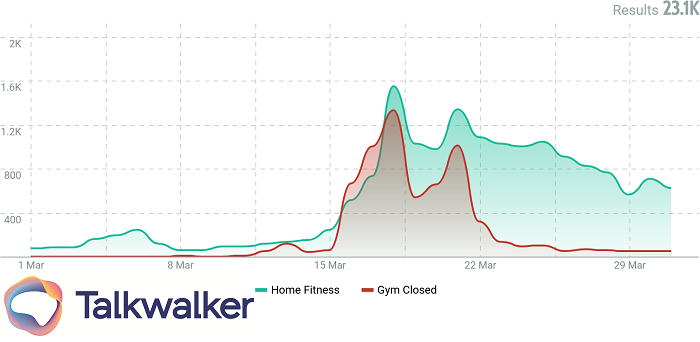

The spikes of gym closures and home fitness peaked a little later, as most closures happened after workplaces and schools. The interesting element here is the second spike which came on Saturday March 21, showing a delayed realization of the impact from people who only use gyms at the weekend.

A second spike of conversations discussing gym closures and home fitness, demonstrates that a significant number of people were only impacted once they hit the weekend — demonstrating that much of the fitness market are weekend only users. Sample: 2%

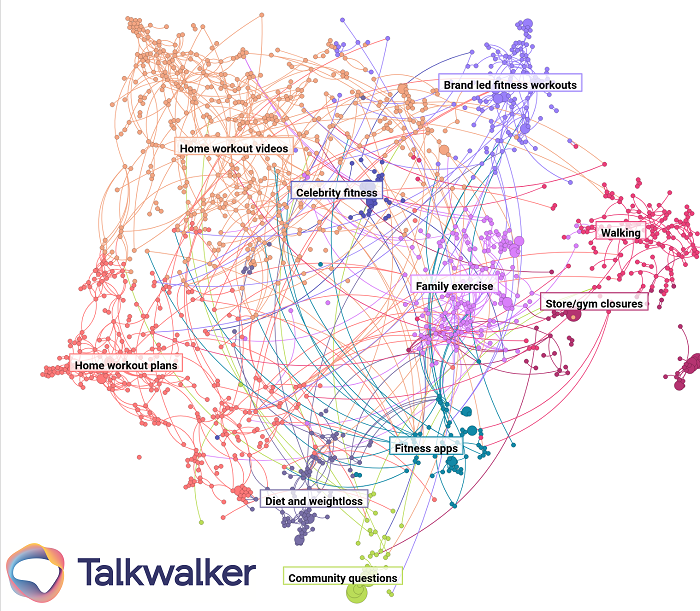

What conversations are driving the trend?

Home fitness is currently dominated by user generated content. Everyday social media users providing classes and plans for all.

Home workout videos (31.3%) and home workout plans (19%)

A vacuum quickly formed, with people looking for easy, understandable ways to stay fit while stuck inside. Everyone from personal coaches, to sports personalities, to influencers, have been sharing routines that people can follow along with.

Instagram makes sharing quick and easy routines, quick and easy. And at this time, information overrides the need for polished content.

And the most common form of exercise at this time? Walking is the simplest and easiest form of fitness.

Walking, yoga, running and weight training are the most popular home fitness methods people are discussing right now.

Family exercise (10.8%)

There’s still a sense of family unity, even when it comes to exercise. People are finding ways to keep fit, while entertaining their children. And of course, encouraging healthier lifestyles for the younger generation too.

Look to engage all age groups in your home fitness program, to broaden your target audience.

Other major conversations

Brand led fitness workouts (9.1%)

With gyms closed, many are now engaging their audience at home, by providing their own home exercise and workout classes.

Live streaming is also another great way to engage audiences instantly.

Diet and weight loss (5.2%)

Losing weight is still quite high up in people’s minds, as they try to counteract the impact of less active lives. A healthy diet is also key to improving your immunity levels.

Exercise and a healthy diet go hand in hand. Both topics worth being part of right now.

Celebrity fitness (2.5%)

And for every trend, there are always the celebrities that want to be part of it. These people could be identified for future influencer marketing campaigns, if suitable.

Celebrities still generate conversations even now. They may be a way to engage your audience in the future.

Technology brands are also popular, as people turn to apps and digital programs to support their fitness regimes. Spotify is of particular note, as people turn to the music app for fitness playlists.

Shipping and Fulfillment Providers

With large-scale shipping concerns and Christmas cut-offs looming, we’ve reached out directly to a number of 3PLs.

None report interruptions in domestic service (last updated: Dec. 9, 6:00am PST). The links below will take you to each provider’s “Status” page:

ShipHero, Promofill, and LeftBrain

Particularly helpful is ShipBob’s Shipping Carrier Data, where you can find weekly time-in-transit updates from the four leading shipping carriers

Also of note is Lumi’s What is the Risk of COVID-19 Transmission on Packages?

While providers are still operational, we suggest reaching out directly. Work stoppages could significantly slow down delivery times and need to be communicated with customers sooner rather than later.

Fast-forward trend 3: Rising competitive intensity

China’s leading companies retain an outsize share of profits and return on investment, but cut-throat competition threatens their position. COVID-19 will raise competitive intensity, creating even bigger rewards, and risks, for companies in China.

In China, the top decile of companies capture about 90 percent of total economic profit, while the ratio is about 70 percent for the rest of the world, according to our analysis of the world’s top 5,000 companies. This leading cohort is comprised of companies that have already digitized and possess highly agile operations, strengths that served them well during the epidemic. For example, Alibaba’s Freshippo supermarkets surmounted supply constraints and met soaring online orders for fruit. Foxconn’s agility allowed it to switch factory operations to mask production, protecting employees, and enabling resumption of production earlier than competitors. Popular short-video platform TikTok announced it was hiring 10,000 new employees when the virus hit a peak. At the other end of the spectrum, weaker companies, particularly SMEs that are not sufficiently agile or digital savvy, are vulnerable to cashflow issues, unemployment, and business failure.

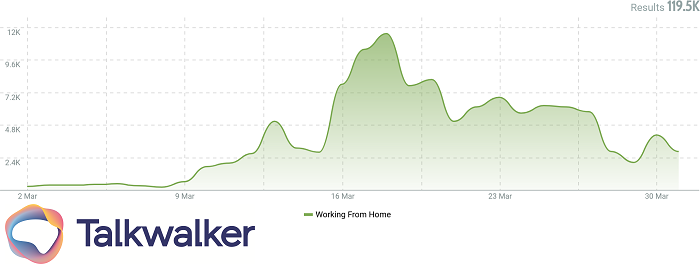

Working from home

Whether following government advice, or using their own discretion, companies have had to close to protect both staff and customers. But were we ready?

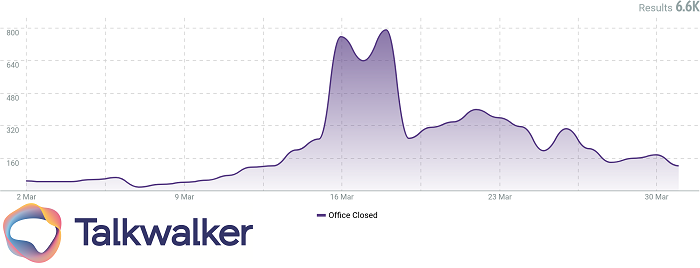

With 330,000 mentions of workplace closures throughout March, the issue became a major talking point when it peaked on March 16. This was led across the country.

Mentions of workplace closures peaked on March 16, with many brands independently deciding to close stores to protect staff and consumers. Sample: 2%

From then on, people had to switch to working from home, where possible. And it seems people were ready. Just. Although the peak came after businesses started closing, there was a large uptick of working from home conversations, demonstrating an awareness that processes would have to adapt before they were needed. A little preparation goes a long way.

Mentions of working from home, started peaking from March 13, demonstrating some mild preparation for the closures ahead. Sample: 2%

When we consider the usual chatter regarding working from home is around 50,000 mentions per week globally, 2.84million mentions from the peak week of the crisis, demonstrates a significant change in consumer habits.

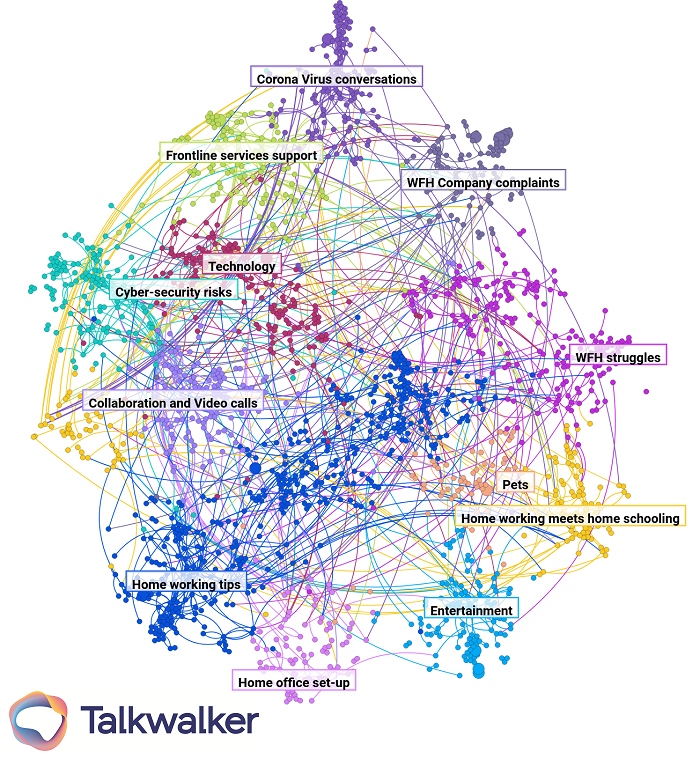

What conversations are driving the trend?

23.1% of working from home conversations are driven by technology and related matters. The displacement of significant parts of the workforce, has required a significant technological input.

Technology (23.1%)

Conversations around technology, fall into 3 main categories —

- The new tech needed to keep working.

- The tech needed to keep in touch.

- Cybersecurity.

Brands have had to invest heavily in updating their processes and workflows, to ensure collaboration can continue from afar. Cybersecurity is a major part of this, providing people with the tools they need, while protecting confidential company data.

Brands should be tackling cybersecurity risks, to protect both the company and their customers.

Home working tips (22.9%)

With working from home only becoming big in the last 2 weeks of March, people are still adjusting. Unsurprisingly then, the conversation is being led by hints and tips about how to handle it.

Sharing great working from home tips, can help build community engagement, and provide consumers with much needed help in a difficult time.

Other major conversations

Working from home struggles (10.9%) — From the serious, to the silly, people are listing the issues they’re facing in this new environment.

Confinement is certainly a real issue now.

Entertainment (6.7%)

After a long day at work (at home), people are craving more entertainment. Including more traditional and nostalgic crafts.

Now is a great time to engage new followers with hands-on activities.

Pets (3.3%)

Of course, if you’re at home all day, then that means more time with your pets. And there’s nothing more exciting on the internet, than pictures of people’s cats or pupers.

Dogs and cats drive excellent engagement even at the best of times. Right now, they’re just the pick-me up people need.

Working from home — brands

The leading tech brands that help people keep in touch are dominating all work from home conversations. Video conferencing tool, Zoom, is mentioned in 0.83% of all working from home conversations, showing a huge uptake of the tool over the last month.

Similar collaboration or efficiency tools such as Skype, Microsoft Office, Google Hangouts, also dominated the topic.

Fast-forward trend 1: Digitization

COVID-19 has not only accelerated digitization in business-to-consumer (B2C) applications and channels, but also the traditionally less digitized part of the economy, such as areas requiring physical interactions, and business-to-business (B2B) processes.

Before COVID-19, China was already a digital leader in consumer-facing areas—accounting for 45 percent of global e-commerce transactions while mobile payments penetration was three times higher than that of the United States. Consumers and businesses in China have accelerated their use of digital technologies as a result of COVID-19. Based on our mobile surveys of Chinese consumers, about 55 percent are likely to continue buying more groceries online after the peak of the crisis. Nike’s first-quarter digital sales in China increased 30 percent year-over-year after the company launched home workouts via its mobile app, while property platform Beike said agent-facilitated property viewings on its virtual reality showroom in February increased by almost 35 times compared with the previous month.

Working practices also changed significantly: enterprise communication platform DingTalk almost doubled its monthly active users in a single quarter to 177 million. In healthcare, digital interactions accelerated—the rapid growth of online consultations, partly thanks to a regulatory shift in reimbursement policy, as well as broader virtual interactions between pharmaceutical sales agents and physicians. These changes occurred ahead of wide deployment of 5G technology, which will likely catalyze the use of digital tools.

As news of COVID-19 spread and as it was officially declared a pandemic by the World Health Organization, people responded by stocking up. They bought out medical supplies like hand sanitizer and masks and household essentials like toilet paper and bread. Soon, both brick-and-mortar and online stores were struggling to keep up with demand, and price gouging for supplies became rampant.

Humans respond to crises in different ways. When faced with an uncertain, risky situation over which we have no control, we tend to try whatever we can to feel like we have some control.

Paul Marsden, a consumer psychologist at the University of the Arts London was quoted by CNBC as saying: “Panic buying can be understood as playing to our three fundamental psychology needs.” These needs are autonomy (or the need to feel in control of your actions), relatedness (the need to feel that we are doing something to benefit our families), and competence (the need to feel like smart shoppers making the correct choice).

These psychological factors are the same reasons “retail therapy” is a response to many different types of personal crises; however, during a pandemic there are added layers.

One is that the global spread of COVID-19 has been accompanied by a lot of uncertainty and at times contradictory information. When people are hearing differing advice from multiple sources, they have a greater instinct to over-, rather than under-, prepare.

Secondly, there is the crowd mentality. Seeing other people buying up the shelves and then seeing a scarcity of necessary products validates the decision to stock up. No one wants to be left behind without any resources.

COVID-19 is Changing the Ecommerce Landscape.

Retail businesses around the world over are being affected by COVID-19 through everything from rapidly changing customer behavior to supply issues.

We’re offering a snapshot of the data around these changes and how businesses are adapting to them.

Fast-forward trend 4: Consumers come of age

China’s affluent younger generation had never experienced a domestic economic downturn prior to COVID-19. The virus has forced them to think harder about spending, saving, and trade-offs in purchasing behavior.

Attitudes to spending among consumers in their 20s and 30s, traditionally the engine of China’s consumption growth, have changed markedly in the wake of COVID-19. One survey showed 42 percent of young consumers intend to save more as a result of the virus. Consumer lending has also declined, while four out of five Chinese consumers intend to purchase more insurance products postcrisis. Savings have also rocketed—the country’s household deposit balance increased by 8 percent over the first quarter to reach 87.8 trillion RMB. Meanwhile, 41 percent of consumers said they planned to increase sources of income through wealth management, investments, and mutual funds.

The virus has also forced purchasing trade-offs, with consumers seeking better quality and healthier options: more than 70 percent of respondents in our COVID-19 consumer survey will continue to spend more time and money purchasing safe and eco-friendly products, while three-quarters want to eat more healthily after the crisis.

Next steps for retailers

COVID-19 and the onset of an economic slowdown may well reshape the landscape of retail deals and partnerships. We encourage retailers to take four steps now as they contemplate M&A and partnerships going forward, grounded in the three C’s of excellent M&A strategists (competitive advantage, capacity, and conviction).

Define the next normal—and your competitive advantage. The first step to redefining M&A and partnership strategy is to understand what the next normal means for each brand and retailer. The new reality will depend largely on how core consumer segments, including behaviors and spending habits, have been impacted by COVID-19. Where are the growth spaces today and where will they be in the future? Where are consumers spending money—which categories and/or channels? How have their tastes, preferences, or concerns changed, driving new opportunities for differentiation or shaping new habits? In this context, how have previous competitive advantages changed and what new advantages have emerged? Identifying the opportunities for growth in the next normal—and which areas can be accelerated via partnerships and M&A—will be the first step to reshaping M&A strategy.

Assess capacity to execute acquisitions and partnerships. A realistic assessment of balance-sheet strength and ability to make acquisitions independently (that is, while debt markets are slowed or frozen), as well as ability to secure financing in the postcrisis environment, will be a key input to evolving M&A strategy. Understanding what targets (and what size targets) are feasible to acquire now versus later should inform how areas of exploration are prioritized. For players with limited cash availability or challenging financial health, partnerships with other players to pool financial resources while addressing strategic priorities could be considered (for example, sourcing collaborations).

Build conviction through identification of key areas of exploration within the M&A and partnership market and think through value creation up front. Retailers should generate data-backed perspectives about market trajectory, new-normal scenarios postcrisis, and the risks of further disruption. Shortlisting top-priority areas and securing executive and board commitment to M&A will accelerate decision making as markets thaw and potential targets are discovered. In the post-COVID-19 tight credit market, we expect that synergy capture expectations, and track record, will matter to investors, which makes it even more important to think through synergy ambitions and value-capture plans up front. We also envision that a potential economic crisis will make it more important to carefully think through how a deal can help to sharpen and/or reposition the joint entity’s value proposition(s) to better service customers’ needs.

Explore opportunities to strike new deals and partner with healthier players. Players without the cash and financial health to pursue acquisitions should identify potential assets to liquidate or potential partnerships to shore up the balance sheet until the crisis passes. The implications of COVID-19 are just as high for potential sellers as they are for potential acquirers.

The retail sector cannot escape the economic impact of COVID-19. But, despite the difficult economic outlook, we expect retail M&A activity to accelerate as the crisis stabilizes, creating opportunities for financially sound players to acquire or partner with less advantaged players. Now is the time for retailers to think about M&A postcrisis. This calls for defining their role in the next normal, reevaluating financial health, segmenting the M&A market, and contemplating new deals and partnerships.

The trend: Cross-network opportunities grow as Google search traffic falls

While people may be spending less time out in brick and mortars and less time on Google search, our internet use is up nearly 50% since COVID-19 became a pandemic. The good news is that you can still reach your prospective customers online—they’re just looking in different places.

Since the beginning of March, Google search and Google Shopping may have taken considerable dives, but there’s still plenty of opportunity out there. Bing Search and Google search partners have remained relatively safe and steady places to find your customers and usually have cheaper CPCs than Google search.

On the other hand, finding your customers off the SERP is becoming increasingly easier! This past week, traffic from the Google Display Network grew 13% since the beginning of the month. And YouTube views are soaring—up 21%! For tips on display advertising during COVID-19, head here.

How to respond: Reach your audience on other networks

1. Now more than ever it’s crucial to advertise across networks

We’re all in for a rollercoaster of a ride on the Google SERP over the next few months as behaviors change. With Google search currently beginning to fall, you’ll have to find other networks to help make up some of that loss. Advertising across multiple networks will help mitigate the volatility of just relying on Google search alone. Additionally, we see that by advertising across networks other than Google search, you’ll find new audiences and even increase the number of people who later search for you on Google.

2. Include Google search partners in your campaigns

Google search partners include many smaller search engines that are powered by Google, like ask.com and countless smaller local search engines. While many may prefer the Google brand of search, the truth is that not every search occurs on Google.com. These partner search engines make up about 10% of Google’s search reach, so consider including them to your campaigns to make up some of the lost search traffic you’re experiencing due to COVID-19.

To include search partners in your campaigns, simply check the “Include Google search partners” box within the networks tab of your campaign settings. To view your ads performance on these search partners, you can segment your data by “Network (with search partners.)”

3. Dive into display and YouTube

With so much of your audience spending more time online, now it’s easier than ever to find them while they browse the web, scroll their social feeds, and watch videos online. Consider starting off by remarketing to your past customers and website visitors to bring them back to your site and keep your brand in their mind. When they return to your site, they’re often much more likely to ultimately convert on their return visits!

It’s unfortunately clear that the coronavirus is going to change our daily lives for the next few months at least. Stay safe and healthy, and practice social distancing. While you’re stuck inside, keep an eye on your PPC accounts and the WordStream blog. We’ll be posting regularly with new data and strategies to best adjust your campaigns in these rapidly changing times.

This report is based on a sample of 15,759 US-based WordStream client accounts in all verticals who were advertising on Google search, display, and YouTube throughout March 2020.

The trend: COVID-19 dominates new searches

As both the virus and news spread exponentially, we’re learning about it in real time. It’s dominant in our minds and in our questions on Google search. Over the past few weeks, searches containing “coronavirus” and “COVID” have certainly taken off. These terms are often appended to everyday searches like “travel booking” or “tax preparation.”

Google search interest for the coronavirus in the United States:

But even outside of searches directly about the virus, the implications of our changing world are bringing people to Google with questions we don’t often see asked. Normally, many of these questions have simple answers, but uncertainty breeds confusion for even simple questions.

From medical necessities, basic needs, and government advisories to Tom Hanks and the 2010 Disney movie Tangled, dormant or brand new searches are becoming incredibly popular. As a result, much of our online marketing is reaching a new audience—often for an unplanned reason. Even on our own website, we’re suddenly seeing extra traffic to this 2017 post for Facebook Live as a result of COVID-19 related searches.

1. Review your search terms report regularly

No one’s favorite PPC task has become even more important as searches quickly explode related to COVID-19 and the disruption it’s causing in both our world and our ad campaigns. No one knows what will be trending tomorrow, so it’s important to understand what traffic your ads are getting and add new negative keywords quickly to prevent your campaigns from reaching irrelevant panicked searchers.

2. Find new negative keywords before they start trending

All your new keywords run the risk of attracting unsavory or irrelevant searches and wasting your campaign budget. Before tomorrow’s news story breaks and irrelevant search traffic flocks to your ads, find new negative keywords with a keyword tool.

3. Follow trending COVID-19 searches

Google Trends is always a great tool to understand how people are searching online. In response to the sudden surge in coronavirus-related searches, Google Trends recently released a new Google Trend Coronavirus Hub, dedicated to these specific COVID-19 search trends. Review the hub regularly to see how people’s priorities and search interests are reacting to the changing news.

Is it Safe to Order Online During COVID-19?

As it becomes even more clear just how infectious COVID-19 is, some shoppers have raised questions about the safety of receiving their online orders. Experts are finding that the virus can live on surfaces from three hours to up to three days, depending on the material. (Note that conclusive findings are difficult to come by in these early days of the virus, and as experts continue their study of it, these numbers may change.)

That said, it’s unlikely that COVID-19 would survive on your purchased items from the time they were packed to the time you received your package (especially with the slowdown in the delivery system). And shipping conditions make a tough environment for COVID-19 as well, so it’s not likely you’ll be exposed via the package itself, either.

According to the CDC, “here is likely very low risk of spread from products or packaging that are shipped over a period of days or weeks at ambient temperatures.” The CDC’s statement refers to packages that have been in shipment for at least several days and did not come into contact with any sources of contamination after packaging.

The World Health Organization addresses the concern as well, by saying that it is safe to receive packages from locations with reported COVID-19 cases. From their website: “The likelihood of an infected person contaminating commercial goods is low and the risk of catching the virus that causes COVID-19 from a package that has been moved, travelled, and exposed to different conditions and temperature is also low.”